However it seems that outside of China the payment operations with WeChat are only available for Chinese citizens who have a valid document of Chinese identification.Īlipay is an online payment platform launched in China by the group Alibaba and its famous founder Jack Ma in 2004. WeChat is a communication service developed by the Chinese company Tencent (Tengxun 腾讯), whose first version was distributed in January 2011 and today counts about a billion active users.īesides being an excellent instant messaging App, WeChat is known throughout the world for its electronic wallet service called WeChat Pay or WeChat Wallet, which allows users to make secure transactions online, to transfer money after connecting your bank account to the App and lots more.Īt the moment, WeChat Pay’s electronic wallet is available in 25 countries throughout the world, including United States, Canada, United Kingdom, Hong Kong, South Africa and Malaysia.

#Wechat pay alipay six more chinese how to#

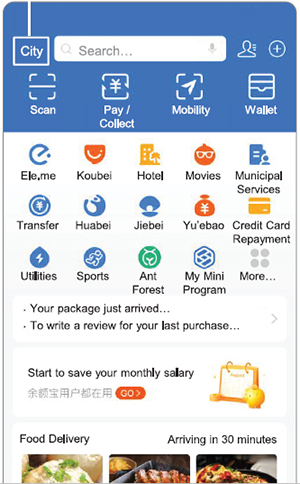

In this guide I will show you the characteristics of payments made through WeChat and Alipay in particular, we’ll see how to choose the initial settings, what are the ways to make payments, how to send and receive money, how the famous hongbao (红包 or “red envelopes”) work, and how it’s possible to use these Apps with foreign credit cards (not issued by Chinese banks). The convenience of the revolution brought about by these applications allows users to make less cash or credit/debit card payments, and as a result accelerate the buying process in a totally safe and quick way. These include the most widespread method of payment in China for any type of commercial activity: restaurants, taxis, supermarkets, cinemas, shopping, waimai (home food delivery), trains, planes, hotel, bike rentals, bills, telephone recharging, etc. In this context, China has already for many years offered its citizens and others the chance to witness and be protagonists in an actual payment revolution thanks to mobile apps like WeChat (Weixin 微信) and Alipay (Zhifubao 支付宝). Technology today offers users numerous advantages and conveniences that make our daily life simpler and saves us precious time.

Alipay had a 54% market share followed by WeChat Pay’s 39% during the three-month period, said the research firm. Mobile payment has increasingly become the payment method of choice among Chinese consumers due to widespread ownership of smartphones and convenience of making secure payments through the scanning of QR codes, a feature available through both Alipay and Tencent Holdings’ WeChat Pay.Ĭhina’s mobile payment reached 47.2 trillion yuan (RM 28.61 trillion) in Q4 2018, up 7.8% from the previous quarter, according to a research note by Analysys. Airports, department stores, pharmacies and convenience stores were among the places that recorded the highest Alipay expenditure.Īlipay is expanding in Japan ahead of the 2020 Olympic Games that Tokyo will host next summer. Transaction volume in Japan during May 1-4 ranked the fourth across all markets, registering an increase of 25% from the same period last year. Asia as a region, led by China, has become a major source of tourist spending in Japan, accounting for 86% of total visitors, according to Ant Financial. More than 8.3 million Chinese people travelled to Japan in 2018, accounting for 27% of total arrivals, according to Alipay. The number of merchants that accept Alipay have surged by about six times from about 50,000 in early 2018. Alipay, the mobile payments arm of Alibaba Group has signed up more than 300,000 retailers in Japan to its m-payments service to serve the growing number of Chinese tourists to the country.Īnt Financial will not charge access fees in extending its services to more retailers in Japan.

0 kommentar(er)

0 kommentar(er)